Business Insurance in and around Hampton

Looking for small business insurance coverage?

Cover all the bases for your small business

This Coverage Is Worth It.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Accidents happen, like a customer stumbles and falls on your property.

Looking for small business insurance coverage?

Cover all the bases for your small business

Insurance Designed For Small Business

With options like worker's compensation for your employees, extra liability, errors and omissions liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Shelton Lucas is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Curious to investigate the specific options that may be right for you and your small business? Simply contact State Farm agent Shelton Lucas today!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

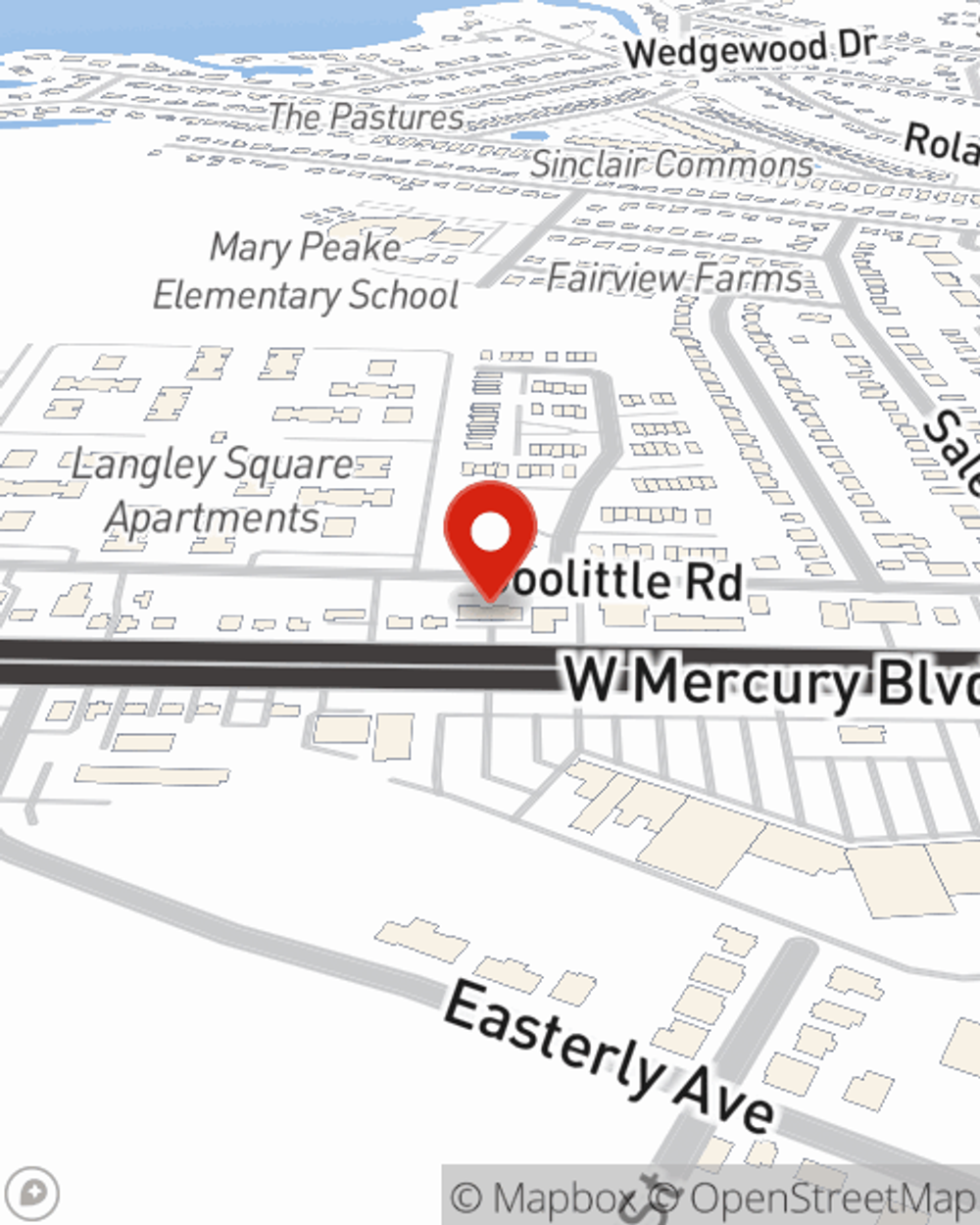

Shelton Lucas

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".